By forex.com

Yet again markets have been fooled by a false dawn when it comes down to the Greek debt crisis. Earlier this week risk was tentatively back on after it was thought that Athens had done enough to guarantee the release of its bailout funds. Then the Eurogroup meeting that was supposed to rubber stamp the deal ended up being a 3.5 hour battle of the wills via teleconference with both the Greeks and the Europeans refusing to negotiate. The final decision on whether Greece gets its next bailout will now be made on Monday.

The Eurozone’s finance ministers are getting bolder in their demands from Greece before they release bailout funds. The Dutch Finance Minister has questioned the expediency of holding general elections in April and suggests a technocratic government a la Italy should be in charge for the next year. Added to this, the Dutch joined the Netherlands and Germany by refusing to agree to release bailout funds before the Greeks go to the polls in two months’ time.

The trouble for financial markets is that once again political risk is coming into play. The Eurozone’s demands have unleashed a wave of patriotism from Athens’ politicians who are trying to save their own hides in the upcoming elections. But on the other side of the fence, European officials have witnessed Greece’s first bailout fail because austerity wasn’t implemented properly and they don’t want to have to explain to their own electorates that they are throwing good money after bad when it comes to helping out Greece.

So now we are at a deadlock with only weeks to go until Greece’s first major bond redemption of the year due on 20th March. How are markets expected to price this type of risk? In the past Greece has always been saved at the last minute, however what if this time is different and the Eurozone cuts Greece loose? How would the markets react to the first ever default by a euro-member nation?

No doubt fear would grip markets, although I don’t believe it would spark a Lehman-like event since central banks globally are already prepared for a Greek crisis and the money spigots are well and truly turned on including at the ECB who offers its next ECB LTRO loans for banks on 29th February.

We believed that potentially the markets may have built up a stronger resistance to Greek issues due to the ECB’s LTRO programme but from a technical perspective the writing was on the wall once EURUSD decisively broke below 1.3080, the early Feb low. Now we are testing the air below 1.30 for the first time in three weeks.

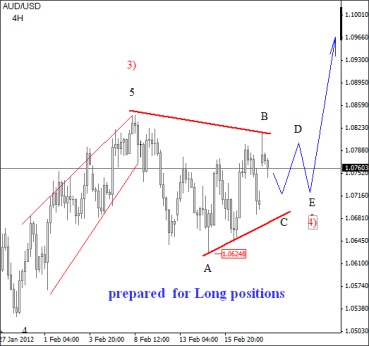

The extent of the sell off is being reflected in EURAUD, which has also clawed back some gains after dropping to all-time lows a couple of weeks ago. This pair tends to recover during periods of risk aversion. In this uncertain environment the Aussie, which has been boosted by some strong fundamental data of late, is following overall risk and stock markets lower today.

The question now is how deep will this pullback be? In the very short term there are signs that EURUSD is starting to look oversold. Thus, we may oscillate around 1.30, added to that there are rumours that 1.2950 is a big barrier level in the market, which could limit EURUSD declines. Upside may be capped at 1.3070 – today’s high. But essentially it’s the bond market that everyone is looking at. Risk only staged its rally once Italian and Spanish bond yields started to fall in recent weeks. So what are bond markets telling us now? Well there are two things to note: 1, yields are rising, but nowhere near the levels they reached at the peak of the crisis last October. 2, Europe’s financially weak states can still sell debt at fairly reasonable rates. For example, Spain sold debt this morning maturing in 2015 and 2019. It was able to attract bids for EUR 4.07bn, higher than the EUR 4.0bn on offer. However yields shot up from 2.86% at an auction earlier this month to 3.32%. This isn’t disastrous, but this increase in yields is worrying so the markets are telling us that the Eurozone isn’t in the danger zone quite yet, but be cautious as risk levels are rising. However, France managed to sell debt at lower yields; it sold 2-year debt with an average yield of 0.89% vs. 1.05% a month ago.

Ahead today US PPI and housing data along with a speech by Fed Chairman Bernanke at 1400GMT may provide a distraction in the markets, but overall Greece is dominating so watch out for negative headlines for Greece and the more ‘political’ the debate becomes the more likely it is to weigh on risk assets.